Navigating VAT compliance is easier than ever with Webtel’s VAT tool. Designed to automate data matching, ensure ZATCA compliance, and simplify your VAT filing process, our solution helps you stay ahead of the curve.

Unposted or delayed e-invoices in ERP systems can disrupt accurate record-keeping and VAT filings.

Manual processes often result in delays in sending invoices to ZATCA, risking non-compliance.

Credit notes often go unprocessed as e-invoices, leading to incomplete or inaccurate reporting.

Mismatched dates between sales data, GL records, and e-invoice platforms create errors that are difficult to identify and resolve manually.

Automate the matching of invoices, credit notes, and GL records to ensure compliance with Saudi Arabia’s ZATCA requirements, without manual intervention.

Track the status of your VAT returns and reconciliation processes from anywhere, at any time, with our secure cloud-based dashboard.

Enjoy peace of mind with automatic, real-time reconciliation across your VAT data, reducing errors and saving time.

Track the status of your VAT returns and reconciliation processes from anywhere, at any time, with our secure cloud-based dashboard.

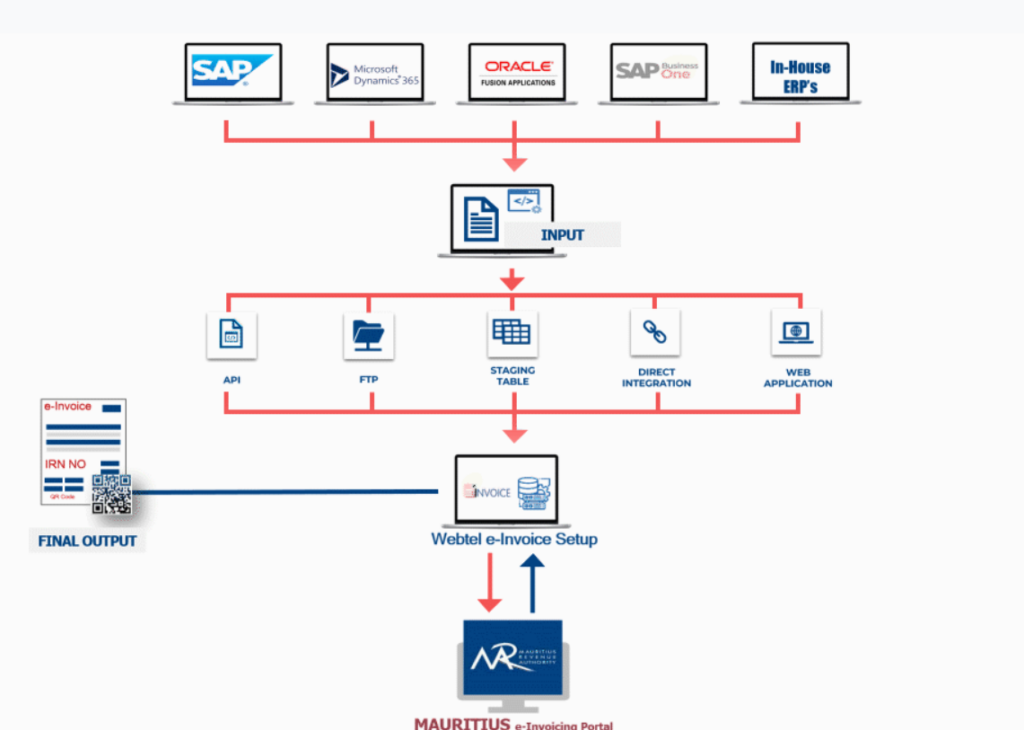

Webtel’s VAT tool offers hassle-free integration with your existing ERP system. Whether you’re using SAP, Oracle, or a custom ERP, the process is seamless, ensuring your data is automatically sent to ZATCA for filing, automated compliance for businesses of all sizes.

Explore the latest trends, updates, and best practices in VAT compliance and reconciliation through our curated blog articles

VAT reconciliation ensures that all sales, purchases, and tax-related transactions match across various records, including e-invoices, credit notes, and GL records. This is vital to meet ZATCA compliance and avoid penalties.

Yes, our VAT tool supports seamless integration with major ERP platforms like SAP, Oracle, Microsoft Dynamics, Tally, and even custom ERP solutions.

The tool automates data fetching, categorization, reconciliation, and reporting. It identifies discrepancies, ensures compliance, and prepares accurate VAT returns for ZATCA submission.

Yes, Webtel’s VAT tool is cloud-based, offering real-time data access, monitoring, and reporting from anywhere.

Prepare Your Business for Effortless VAT Compliance with Webtel

Get ahead of VAT filing challenges and ensure ZATCA compliance with Webtel’s seamless VAT reconciliation tool.

110-114, 1st Floor Rattan Jyoti Building, 18, Rajendra Place, New Delhi-110008

Webtel Technologies C Corp 7731 Lamparas Dr, Sparks, Nevada 89436, USA.

Copyright 2024 © Webtel Electrosoft Pvt. Ltd. | All Rights Reserved